Here are five recommended reads for today (5/20/14) Greentech Media reports: ” Securitization, the holy grail of energy efficiency finance, has finally

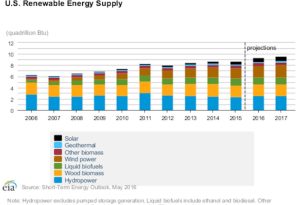

EIA Renewable Energy Forecast Isn’t Just Wrong, It’s Wildly, Laughably Too Low

I hate to criticize the federal agency I worked at for 17+ years, especially since the Energy Information Administration (EIA) does

Touring Ivanpah: Photos from an Amazing Solar Project

Cross posted from Tigercomm By Mark Sokolove, Executive Vice President On Tuesday, I had a chance to tour one of

Growing the Options: Showing the Clean Economy is Good Politics and Policies

There are a lot of venues where clean economy players network and do business. Michael Liebreich’s excellent Bloomberg New Energy

Growing the Options: Mid-Atlantic Clean Economy Leaders Roundtable With Former Virginia Governor Tim Kaine

Cleantech deniers are spending big these days to bolster their lobbying agenda. They’re airing hundreds of millions of dollars worth of

Stacy Lambe: Is Media Heading Towards the BuzzFeed Model?

In our first post on BuzzFeed editor Stacy Lambe’s recent Scaling Green Communicating Energy Lecture Series appearance, we covered his thoughts on how clean energy

Cleantech Comms Vet: How Clean Energy Can Stop Being Boring

Texts from Hillary co-creator and Tigercomm veteran Stacy Lambe recently became an editor at the popular “social news” website BuzzFeed. He’s now in

Interviewing Matt Wald, Dean of the Energy Press Corps

In case you were thinking of it, I wouldn’t recommend trying to stump Matt Wald, the national energy reporter for

New “Clean Energy Under Siege” Report Details Dirty Energy Misinformation Tactics

A new report by the Sierra Club follows the money trail behind the “attack on renewable energy.” A few of the

Michael Grunwald: Solyndra’s Demise Was “a shame…not a scandal”

At Time’s “Swampland” blog, Michael Grunwald has a superb article entitled, “Why on Earth Would the Obama Campaign Call

Interview: Concentrating Solar Power Alliance Executive Director Frank “Tex” Wilkins

Last week, we interviewed Belen Gallego, Founder & Director at CSP Today and PV Insider, in conjunction with the CSP Today 6th Concentrated Solar

New Analysis: Renewables the Fastest-Growing U.S. Industry Between 2007 and 2011

The LinkedIn blog has some fascinating information we thought was well worth sharing: How has our economy evolved in the past

White House Makes Correct Decision on Keystone; Big Oil and its Paid-For Politicians Scream

Yesterday afternoon, the White House issued a statement rejecting – at least for now – the proposed Keystone XL tarsands pipeline from

Solar Industry Executives Talk About the Solyndra Non-“Scandal”

A few weeks ago, my Tigercomm colleague Mark Sokolove and I were able to take Scaling Green’s Communicating Energy lecture series on the

Solar Industry Executives Talk About Massive Solar Jobs Growth

In mid-October, my Tigercomm colleague Mark Sokolove and I took Scaling Green’s Communicating Energy lecture series on the road to the Solar Power International

Video, Photos: 12,000+ People Surround White House Demanding a Stop to Dirty Tar Sands Pipeline

I was at Lafayette Park and around the White House today, participating in and covering the massive protest against

Cornell University Study: Keystone Pipeline “may actually destroy more jobs than it generates”

You’ve probably seen ads by the oil industry (hard to miss, they’re pretty much ubiquitous) claiming that the proposed Keystone Canadian oil sands

Solar Foundation Director on Energy Policies States Like Virginia Should Be Pursuing

Recently, Andrea Luecke of the Solar Foundation provided a briefing on her organization’s release of a groundbreaking study on solar jobs in America.

Anti-solar Pundits and Politicians Are Wrong: The Solar Foundation’s Andrea Luecke Shows That Solar’s Growing Fast

If the latest job numbers from The Solar Foundation’s (TSF) National Solar Jobs Census 2011 are any indication, the bloviating by

New Economic Analysis: Coal Expensive, Underregulated

Back in February, a new Harvard study found that “when the entire life-cycle of coal is considered — extraction, transport, processing,

ExxonMobil Launches Pro-Fracking Campaign

From the same people who brought us junk science, and who help bring us the Big Lie “Energy Tomorrow” propaganda campaign, now

Top EIA Energy Trends Watcher: No Definitive Count on Dirty Energy Welfare

The national conversation about wasteful welfare for highly profitable dirty energy corporations has gone from the dramatic statement by the Chief

Great Idea: $40 Billion in Cuts to Wasteful Big Oil Subsidies

Several members of the U.S. House of Representatives are promoting a plan to cut $40 billion in “wasteful big

How the Other Guys Play

Americans want deficit cuts, and there is a new set of leaders in Congress who committed themselves last year to

Meet George Allen, Big Government Spender

Former Virginia Governor and U.S. Senator George “Macaca” Allen is now Chair of something called the American Energy Freedom Center.

Chevron’s “Human Energy” Spent Pioneering New Form of Pollution – Cleantech Washing

As part of its campaign to defeat the climate legislation that was beginning to move in Congress a few

Fossil Energy Knows It’s a Full Contact Game – Does Cleantech?

Cancun – When I started working on solar energy issues several years ago, I repeatedly heard: “Everyone loves solar.” Back

“The Dark Lord of Coal Country” to Retire; the Damage He Did Will Endure Forever

Late last week came word that Don Blankenship CEO of Massey Energy, the largest coal producer in central Appalachia – will

Still Doubt the Dirty Energy Lobby’s Power? Read how they got more of your money…

The Center for Public Integrity (CPI) has a fascinating new piece, Big Polluters Freed from Environmental Oversight by Stimulus. According to CPI:

Time for Solar to Push Back

Solar now enjoys a powerhouse set of assets that many industries spend dearly to acquire: explosive growth, wide and

Latest PostsView all

Five Energy Stories Worth Reading Today (5/20/14)

1040 viewsHere are five recommended reads for today (5/20/14) Greentech Media reports: ” Securitization, the holy grail of energy efficiency finance, has finally

0